Top 5G Stocks in India That Could Deliver Strong Returns in 2025

Introduction

India is witnessing a transformative shift with the nationwide rollout of 5G technology, marking a new era in digital connectivity. As per insights from the Ericsson Mobility Report, India is projected to have over 270 million 5G users by the close of 2024, making up approximately 23% of the nation's overall mobile user base. This number is projected to surge to 970 million by 2030, covering 74% of all mobile users.

As 5G adoption accelerates, the Indian economy is poised to benefit across sectors such as manufacturing, healthcare, and logistics. Fueling this rapid growth, MarketsandMarkets projects that the global 5G services market will soar to USD 1,002.3 billion by 2028, driven by a robust CAGR of 52.4%. In this rapidly evolving landscape, several Indian companies are emerging as frontrunners in 5G deployment—creating compelling opportunities for investors.

This article delves into the top 5G stocks in India for 2025, backed by data, performance insights, and future growth potential.

What Are 5G-Related Stocks in India?

5G represents the next evolution in wireless communication, delivering ultra-fast data speeds, reduced latency, and enhanced device connectivity. In India, 5G-related stocks are companies involved in building or supporting the 5G ecosystem—ranging from telecom service providers to firms supplying network infrastructure, semiconductors, and software solutions. These businesses are central to India’s 5G rollout and hold strong potential for long-term growth.

Expected Market Size of the 5G Industry

The global 5G market is set to grow swiftly, expected to hit USD 668.3 billion by 2028 with a CAGR of 52.4%, according to Markets and Markets.

In India, the 5G sector is on a similar high-growth trajectory. Backed by aggressive investments from telecom operators and significant government spending on infrastructure and spectrum, the Indian 5G ecosystem is set to expand rapidly. The surge in demand for high-speed connectivity, 5G-enabled devices, and next-gen applications like IoT, AI, and cloud services will drive the sector’s momentum over the next few years.

In the Union Budget for 2025–26, the government reaffirmed its commitment to digital advancement by allocating a budget of Rs. 22,000 crore to the BharatNet initiative and boosting the Universal Service Obligation Fund to Rs. 20,000 crore, aiming to enhance rural 5G connectivity and infrastructure.

Top Picks for 5G Stock Investments in India

Below is a table highlighting the top picks for 5G stock investments in India, showcasing companies poised to benefit from the country's 5G expansion.

|

No. |

Company Name |

Market Cap (Cr.) |

P/E Ratio |

52-Week High (Rs. ) |

52-Week Low (Rs. ) |

|

1 |

Rs. 16,04,059.80 |

23.2 |

1,608.80 |

1,114.85 |

|

|

2 |

Rs. 9,95,049.40 |

40.4 |

1,779.00 |

1,198.30 |

|

|

3 |

Rs. 50,617.70 |

-1.8 |

19.18 |

6.61 |

|

|

4 |

Rs. 10,828.70 |

29.4 |

171 |

71.6 |

|

|

5 |

Rs. 3,651.60 |

-21.7 |

155.05 |

72.1 |

|

|

6 |

Rs. 44,099.50 |

39.5 |

2,175.00 |

1,291.00 |

|

|

7 |

Rs. 14,238.90 |

21.4 |

1,495.00 |

646.55 |

|

|

8 |

Rs. 80,009.10 |

101.3 |

19,148.90 |

7,198.35 |

Overview of the Top Three 5G Stocks

-

Reliance Industries Ltd.

Reliance Industries Limited (RIL), a leading Indian conglomerate, is strategically advancing in the 5G sector through its subsidiary, Reliance Jio. The company has committed approximately Rs 2 lakh crore to develop a comprehensive pan-India 5G network, with initial rollouts planned for major metropolitan areas.?

Strengths:

-

Robust Revenue Growth: In Q4 FY24, RIL reported gross revenue of Rs 2,64,834 crore, marking a 10.8% year-over-year increase. ?

-

Strong EBITDA Performance: The company's EBITDA for the same quarter stood at Rs 47,150 crore, reflecting a 14.3% growth compared to the previous year. ?

-

High promoter stake shows strong trust and long-term commitment to RIL.

Limitations:

-

Flat Net Profit Growth: Despite revenue and EBITDA growth, RIL's net profit remained relatively flat at Rs 21,243 crore in Q4 FY24, primarily due to increased tax expenses. ?

-

Elevated P/E Ratio: The company's stock trades at a high price-to-earnings ratio, suggesting that the market has significant expectations for future earnings growth, which may affect immediate investment returns.?

In summary, RIL's substantial investments in 5G infrastructure, coupled with strong revenue and EBITDA performance, position it favorably in India's burgeoning 5G market. However, potential investors should consider the flat net profit growth and high valuation metrics when evaluating investment opportunities.

-

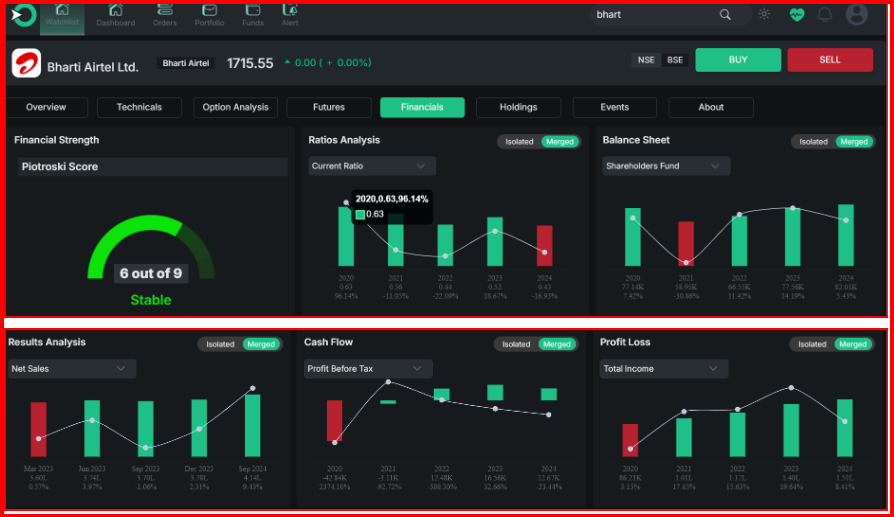

Bharti Airtel Ltd.

Bharti Airtel Limited, a leading Indian telecom provider, has been actively advancing its 5G deployment strategy. In 2022, Airtel invested Rs. 43,084 crore to acquire 19,800 MHz spectrum across key bands like 900, 1800, 2100, 3300, and 26 GHz, securing rights for 20 years. This move gave the company nationwide access to 3.5 GHz and 26 GHz bands, critical for rolling out 5G services.

Strengths:

-

Profit Growth: Over the past three years, Airtel has achieved a profit growth of 30.02%.?

-

Operating Margins: The company has maintained an average operating margin of 46.88% over the last five years.?

-

PEG Ratio: Airtel's Price/Earnings to Growth (PEG) ratio stands at 0.01, indicating potential undervaluation relative to its earnings growth.?

-

Cash Conversion Cycle: The company has an efficient cash conversion cycle of 8.95 days, reflecting effective working capital management.?

-

Promoter Holding: Airtel benefits from a high promoter holding of 53.11%, suggesting strong confidence from its primary stakeholders.?

-

Operating Leverage: The company exhibits a strong degree of operating leverage, with an average of 10.53, indicating that a significant portion of its costs are fixed, potentially leading to higher profits with increased sales.?

Limitations:

-

Revenue Growth: Airtel has experienced a modest revenue growth of 13.53% over the past three years, which may be considered low in comparison to industry peers.?

-

Return on Equity (ROE): The company's ROE stands at 0.12% over the past three years, indicating limited returns generated on shareholders' equity.?

-

Airtel's current P/E ratio stands at 65.39, indicating that the stock might be priced higher than its actual earnings justify.

In summary, Bharti Airtel's substantial investments in 5G spectrum and its robust operating margins position it favorably in the evolving telecom landscape. However, potential investors should weigh these strengths against the company's modest revenue growth, low ROE, and high P/E ratio when considering investment opportunities.

-

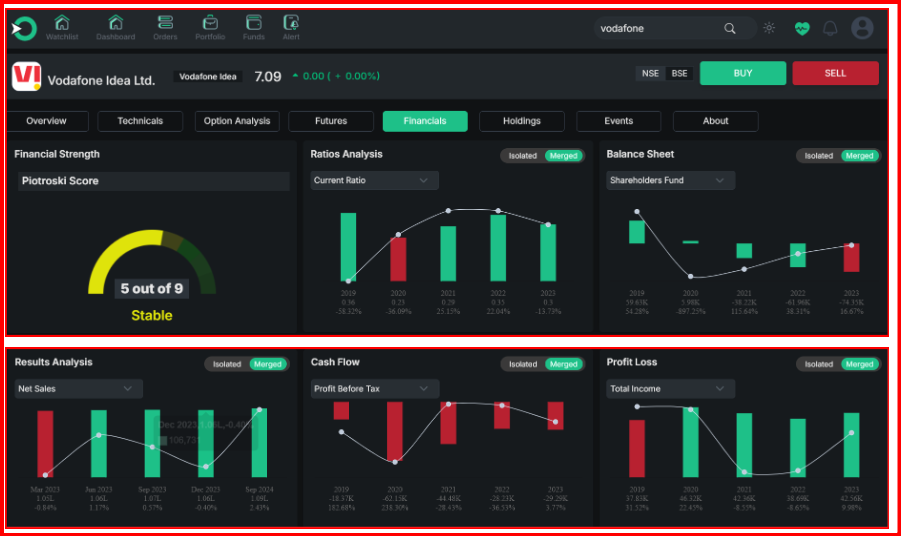

Vodafone Idea Ltd.

Vodafone Idea Limited (Vi) remains a significant player in India's telecom sector, despite ongoing financial challenges. The company has entered into strategic partnerships to accelerate its 5G deployment plans. Notably, in September 2024, Vi finalized a $3.6 billion deal with Nokia, Ericsson, and Samsung to supply network equipment over three years. This initiative aims to expand 4G coverage and introduce 5G services in key markets. ?

Strengths:

-

Operating Margins: Vi has maintained an average operating margin of 37.84% over the past five years, indicating effective cost management.?

-

The company has an effective cash conversion cycle of 18.32 days, showcasing its ability to quickly turn investments into cash flow.

-

Operating Leverage: With an average operating leverage of 5.20, Vi demonstrates the potential for amplifying profits through increased sales.?

Limitations:

-

Over the last three years, Vi has recorded a modest 9.84% rise in profit, indicating ongoing difficulties in boosting overall profitability.

-

The company's revenue growth stands at a minimal 0.52% over the same period, highlighting difficulties in expanding its market share.?

-

Vi has reported an ROE of 0% over the past three years, indicating no returns generated on shareholders' equity.?

-

The company has a negative ROCE of -4.65% during the same timeframe, reflecting inefficiencies in utilizing capital.?

-

Vi's negative book value points to liabilities exceeding assets, underscoring financial instability.?

In summary, Vodafone Idea's strategic collaborations and operational efficiencies position it to leverage the growing 5G market. However, its financial constraints and limited growth metrics present substantial risks. Investors should carefully assess these factors when considering potential opportunities with the company.

5-Year Financial and Market Performance Comparison: Reliance Industries vs Bharti Airtel vs Vodafone Idea

|

Parameter |

Reliance Industries Ltd |

Bharti Airtel Ltd |

Vodafone Idea |

|

Revenue Growth (5-Year CAGR) |

9.69% (vs industry avg 8.87%) |

12.31% (vs industry avg 7.49%) |

0.64% (vs industry avg 7.49%) |

|

Market Share (5-Year Change) |

32.14% → 33.36% |

53.88% → 66.86% |

26.34% → 18.88% |

|

Net Income Growth (5-Year CAGR) |

11.95% (vs industry avg 17.55%) |

Not provided |

Not provided |

|

Debt-to-Equity Ratio (5-Year Avg) |

50.37% (vs industry avg 66.21%) |

189.33% (vs industry avg -363.25%) |

Negative, 99.32% |

|

Current Ratio (5-Year Avg) |

107.03% (vs industry avg 89.43%) |

48.43% (vs industry avg 38.05%) |

22.61% (vs industry avg 38.05%) |

Over the past five years, Bharti Airtel has shown the strongest growth, with a 12.31% revenue CAGR and a major market share gain from 53.88% to 66.86%, though it carries high debt. Reliance Industries maintained steady growth, modestly increasing its market share and showing strong financial stability with a low debt-to-equity ratio and high liquidity. In contrast, Vodafone Idea has underperformed, with minimal revenue growth, a declining market share, and weak financials, marked by high debt and low liquidity.

Key Factors to Consider When Investing in 5G Stocks

When selecting 5G stocks, focus on companies with a strong market presence and a growing user base. Assess the dependability of their 5G network and the standard of services provided. Look for firms actively innovating in next-gen tech like IoT and AI. Strong financials and consistent growth are essential indicators of stability. Strategic alliances with tech leaders can also boost a company's ecosystem. Finally, track share price trends to assess market confidence.

Notable Characteristics of 5G Stocks

5G stocks are typically tied to firms directly building or enabling 5G infrastructure. These may include telecom service providers, hardware manufacturers, and software developers. Many of these companies lead innovation in fields like AR/VR, automation, and real-time data. Investors can find opportunities in both established industry giants and emerging 5G penny stocks, reflecting a mix of local and global influence.

Why Invest in 5G Stocks?

Investing in 5G opens the door to future-focused growth. Early entrants stand to benefit as adoption scales rapidly. The sector includes both large-cap and affordable penny stocks, offering flexible entry points for diverse portfolios. With 5G accelerating innovations across sectors, companies in this space are likely to see long-term expansion. Moreover, India's supportive policy environment and government funding further enhance the outlook.

Risks of Investing in 5G Stocks

Despite high growth potential, 5G investments carry certain risks. Penny stocks, in particular, are prone to volatility, influenced by market speculation. Regulatory changes or delays in spectrum rollout can also impact revenues. As the technology continues to evolve, not all companies will keep pace, potentially affecting stock performance. In addition, Indian firms must navigate stiff global competition.

Essential Factors Before Investing in 5G

Before committing capital to 5G stocks, evaluate the financial soundness of the company and its long-term strategy. Focus on businesses with a strong role in the 5G ecosystem and an edge in innovation. Diversify across multiple players—both in India and abroad—to mitigate risks. Stay informed about the changing regulatory environment, which can directly affect growth prospects.

Conclusion

India’s 5G revolution is set to reshape the digital landscape, and investors stand to benefit by identifying companies leading this shift. Reliance Industries, Bharti Airtel, and Vodafone Idea each offer unique opportunities and challenges within the 5G space. While Reliance and Airtel show financial resilience and growth potential, Vodafone Idea’s turnaround hinges on execution. As the 5G rollout gains momentum in 2025, these stocks are worth watching for those aiming to tap into India’s digital future.

For the latest updates on 5G stocks, including live prices, market news, and expert analysis, visit Enrich Money. Open a free demat account with no annual charges and start investing with the best trading app for beginners in India.

Frequently Asked Questions

-

Is 5G technology promising in India’s future?

Yes, 5G is set to transform India’s infrastructure by enabling smarter cities and efficient connectivity through IoT.

-

What is the right time to invest in 5G-related stocks?

Ideally, invest when 5G deployment scales up. It’s wise to seek guidance from a financial expert before making any investment decisions.

-

Which are the top 5G stocks to watch in India for 2025?

Top picks include Reliance Industries, Bharti Airtel, and Vodafone Idea, along with HFCL, Sterlite Technologies, and Tejas Networks.

-

How is the Indian government supporting 5G growth?

Through large allocations in the 2025–26 Budget for BharatNet and spectrum rollout, indicating strong policy support for digital infrastructure.

-

How can I identify the best 5G stocks in India?

Look for companies with strong financials, consistent revenue growth, investments in 5G infrastructure, and strategic partnerships. Platforms that provide in-depth stock research, historical performance analysis, and sector-specific insights can be immensely helpful in making informed decisions.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.